Life Insurance in and around Houston

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Austin

- Bastrop

- Bee Cave

- Brenham

- Bryan

- Conroe

- Canyon Lake

- College Station

- Cypress

- Huntsville

- Katy

- Livingston

- Magnolia

- Montgomery

- New Braunfels

- Richmond

- Rosenberg

- San Antonio

- San Marcos

- Spring

- The Woodlands

- Tomball

- Victoria

- Waco

Protect Those You Love Most

It can be a big deal to take care of your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or pay for college as they face the grief and pain of your loss.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Life Insurance You Can Trust

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep those you love safe with a policy that’s adjusted to align with your specific needs. Luckily you won’t have to figure that out on your own. With empathy and fantastic customer service, State Farm Agent Steve Sipes walks you through every step to create a policy that protects your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Steve Sipes's office today to check out how a company that processes nearly forty thousand claims each day can work for you.

Have More Questions About Life Insurance?

Call Steve at (832) 619-1397 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

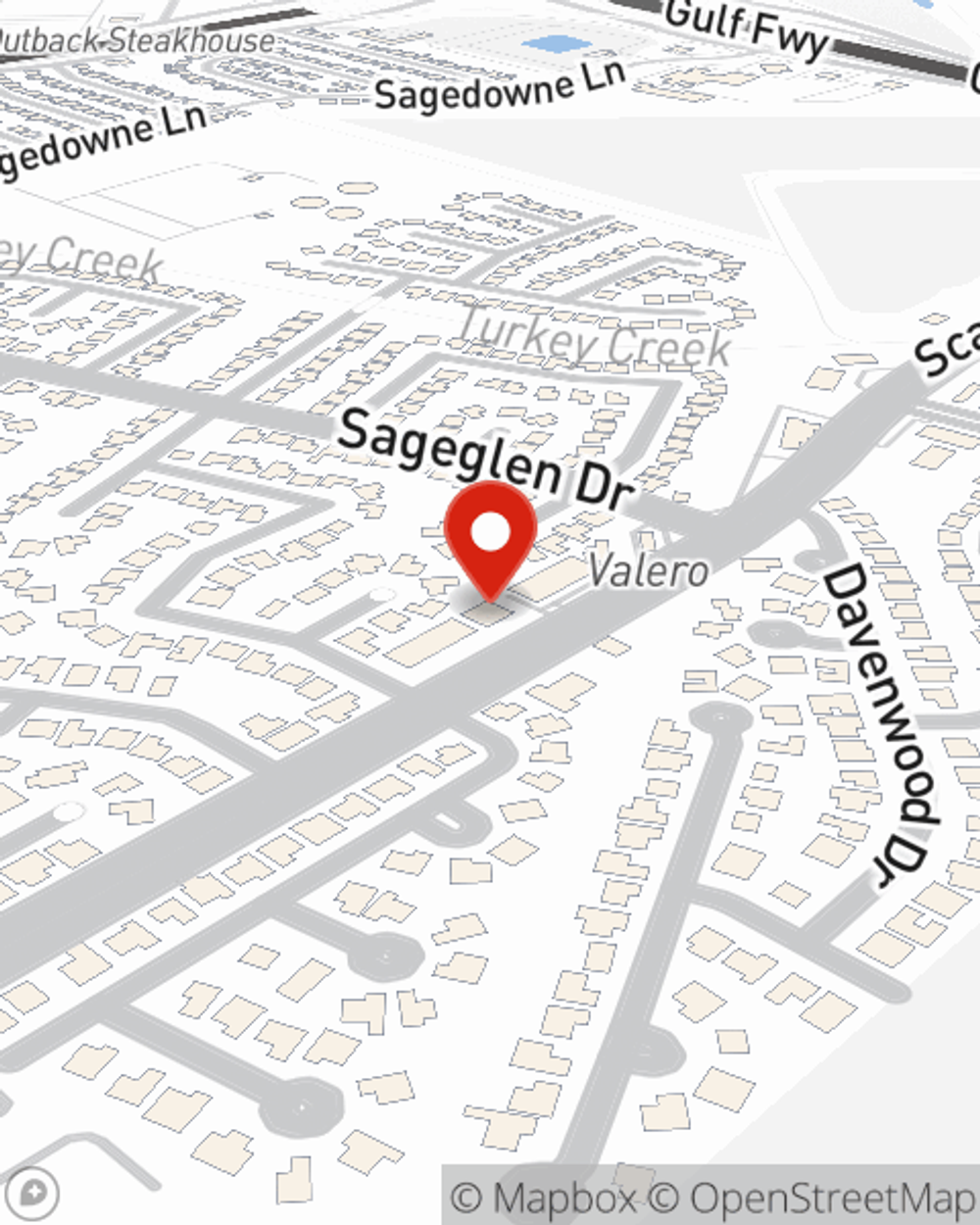

Steve Sipes

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.